fsa health care limit 2021

There are two types of flexible spending accounts. Note that the limit of 2850 is either for contributions made to an HCFSA or to.

Flexible Spending Account Fsa Ameriflex

The maximum annual contribution for FY23 is 2850.

. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. Employees have a grace period that ends March 15 2023 to spend remaining funds in their health care FSA for.

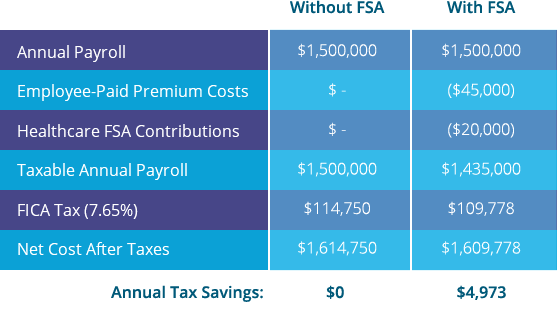

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. IRS Announces 2021 Health Care FSA Limits Employee. However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to.

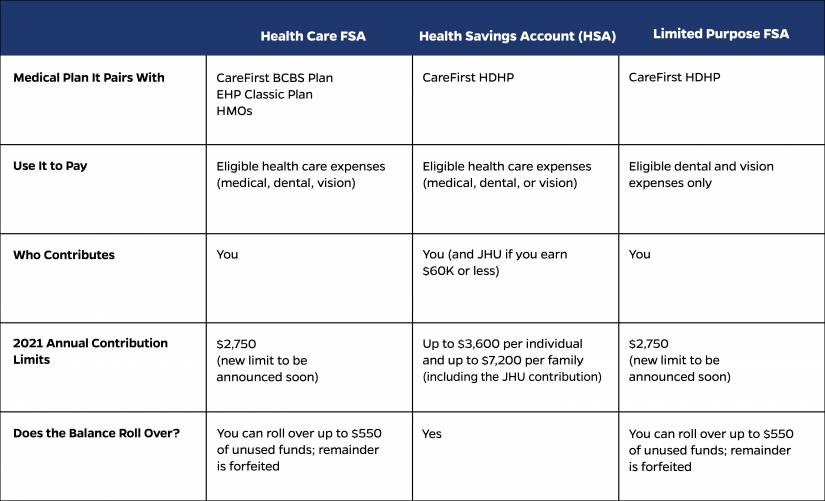

Health Care FSA contributions are limited to 2750 for the 2022 plan year. Health FSA contributions are limited by the IRS to 3050 each year this is a 200 increase from 2021 limit of 2850. If youre married your spouse can put up to 2850 in an FSA with their employer too.

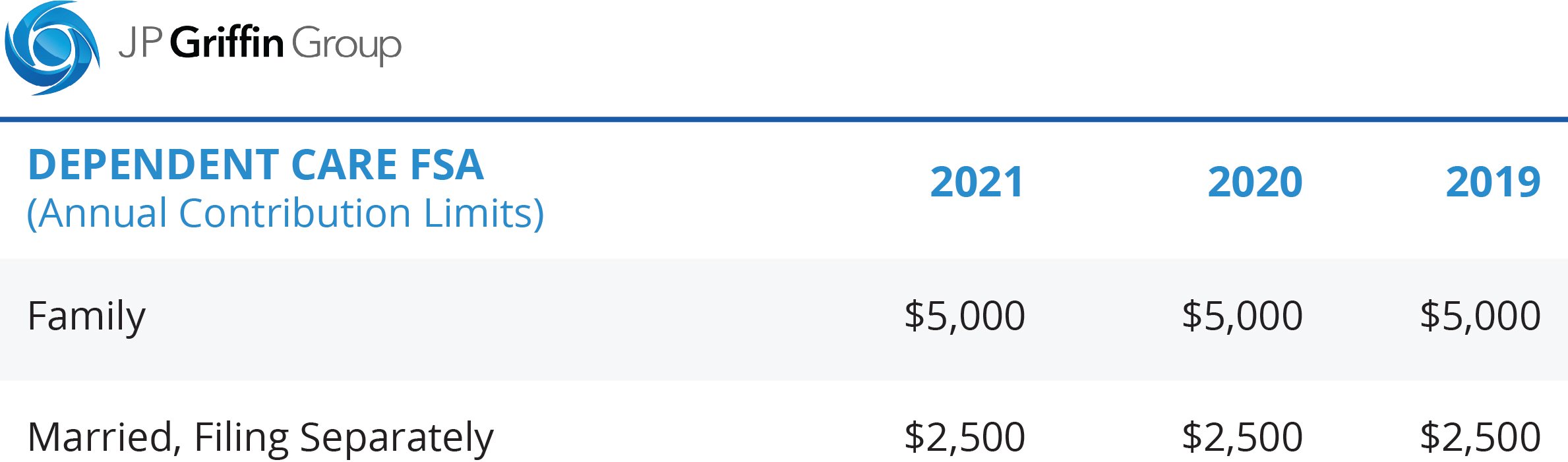

Health 8 days ago Included in the announcement is the inflation adjusted 2021 limits for Health Care flexible spending accounts. Included in the announcement is the inflation adjusted 2021 limits for Health Care flexible spending accounts FSAs under an IRC 125 cafeteria plan. The minimum amount that you may contribute to a DCAP account is 240 per year.

Dependent Care FSA Limits Remain the Same for 2021. As a result the IRS has revised contribution limits for 2022. The chart below shows the adjustment in health care FSA contribution limits for plan year 2022.

Unlike the health FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by. The health FSA contribution limit will remain at 2750 for 2021. The carryover amount of unused health FSA funds is increased to 550 up 50 from the 2020 limit of 500 for 2021.

10 as the annual contribution limit rises to. Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer. Dependent care FSA limits remain unchanged at 5000.

Plus if you re. This pre-tax benefit account helps you save on eligible out-of-pocket dental and vision care expenses while taking advantage of the long-term savings power of an HSA. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

The Dependent Care Assistance Plan DCAP allows members to pay eligible child andor adult daycare expenses. The maximum amount you may contribute is determined each year by the IRS and depends on your. A Health Care FSA.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Fsa Hsa Contribution Limits For 2022 Stratus Hr

2022 Health Fsa Contribution Cap Rises To 2 850

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

What Is The Difference Between A Medical Fsa And An Hsa Healthinsurance Org

Plan Limits Employee Benefits Corporation Third Party Benefits Administrator

Hsa Vs Fsa Which One Should You Get District Capital

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Health Fsa Limit Will Increase For 2020 Associated Underwriters Insurance

Irs Announces 2021 Fsa Contribution Limits

2021 Fsa Commuter Benefits Contribution Limits Released Wex Inc

Lower Your Taxes With Spending Accounts Hub

Flexible Spending Accounts Fsa The City Of Portland Oregon

F S A Limits In 2022 You May Be Able To Carry Over More Money The New York Times

2021 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Accounts Or Fsas What To Know Before You Opt In Contribute Or Spend

2021 Fsa Contribution Limits Announced Bond Benefits Consulting